Press Release

|March 17,2025Mass Market New Home Sales Led The Way, Posting 9-Year High Sales In February 2025 On Robust Demand At Parktown Residence And ELTA

Share this article:

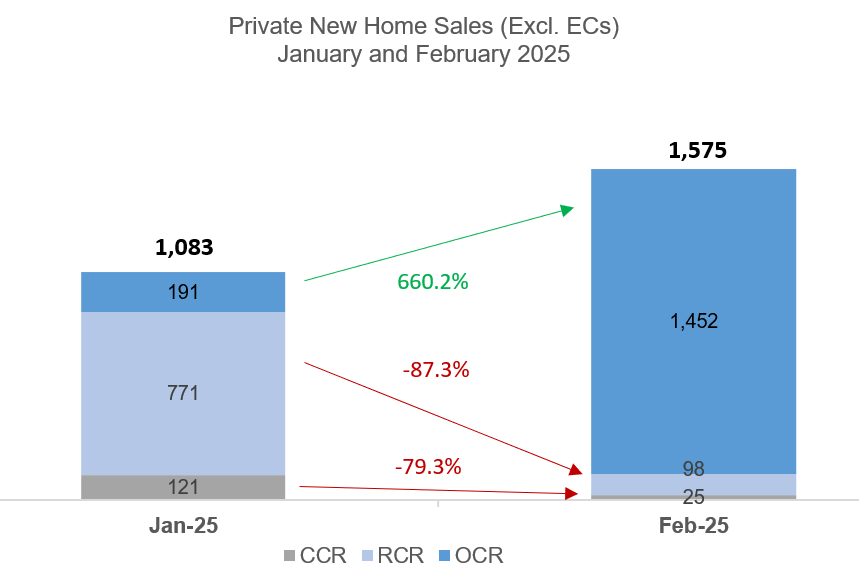

17 March 2025, Singapore - Developers achieved another strong month of new home sales in February, with 1,575 new units (ex. executive condo) sold in the month, thanks to the stellar performance at a couple of new launches. This marks a 45% jump from the 1,083 units shifted in January; year-on-year, sales were up by more than 10 times from the 153 units transacted in February 2024.

February's sales were single-handedly propped up by the Outside Central Region (OCR) or mass market, which made up a whopping 92% of the month's transactions, at 1,452 units (ex. EC) - reflecting the best monthly showing for this sub-market in more than 9 years, since 1,523 units were sold in July 2015. The two new OCR launches in February, Parktown Residence and ELTA collectively accounted for 87% of new home sales in the month.

Developers placed 1,694 new units (ex. EC) for sale in February, up sharply by 89% from 896 units launched in January. All the units launched in February are in the OCR, namely from Parktown Residence and ELTA.

There were 1,452 new units (ex. EC) sold in the OCR in February, marking a sharp spike from the 191 units moved in the previous month. Integrated development Parktown Residence in Tampines was the top-selling project in February, shifting 1,041 units at a median price of $2,363 psf (see Table 3). Meanwhile, ELTA in Clementi - also launched in February - sold 326 units at a median price of $2,538 psf. In March, developers' sales in the OCR look set to be lower, as there was only one new OCR project (ex. EC) launched during the month, being Lentor Central Residences, which transacted 93% of its 477 units over its launch weekend.

The Rest of Central Region (RCR) saw 98 new units sold in February, down by 87% from the 771 units transacted in the previous month, where The Orie had boosted sales. The popular RCR projects during the month included Pinetree Hill which sold 22 units at a median price of $2,613 psf, Nava Grove which moved 18 units at a median price of $2,574 psf, and The Continuum that transacted 10 units at a median price of $2,906 psf. Looking ahead, new home sales in the RCR are expected to remain relatively muted in March amid a dearth of new launches in this sub-market.

Over in the Core Central Region (CCR), developers sold 25 new private homes during the month, falling from the 121 units transacted in January. The project that garnered the most transactions was 19 Nassim which sold five units at a median price of $3,372 psf, followed by One Bernam which sold four units at a median price of $2,651 psf in February. The 351-unit One Bernam is now fully sold, since it was launched for sale in May 2021. Generally, developers' sales the CCR may remain muted relative to the other sub-markets, owing partly to the additional buyer's stamp duty (ABSD) measure. Earlier in March, a new project launch, the 188-unit Aurea in Beach Road sold 23 out of the 78 units released for sale.

Meanwhile, there were 29 EC transactions in February compared with the 21 units sold in the previous month. The top-selling EC project was Novo Place in Tengah which shifted 17 units at a median price of $1,676 psf. Sales of new ECs will jump sharply in March with the strong take-up at Aurelle of Tampines EC earlier this month, where 682 out of 760 EC units were sold when it was put on the market. In view of the robust sales at Aurelle of Tampines, the overall stock of unsold new ECs in the market remains relatively tight, and will continue to give developers the impetus to bid for new EC sites under the government land sales programme.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty said:

"Brisk sales at Parktown Residence and ELTA have supercharged new home sales in February, extending the trend of healthy take-up rates at many new launches since November 2024. The two projects were expected to do well, owing to the allure of integrated development in the case of Parktown Residence, and proximity to schools and the Clementi town centre where ELTA is concerned. To this end, their sales performance did not disappoint, and the healthy transactions despite benchmark average $PSF launch prices in the respective Tampines and Clementi planning areas is indicative of the resilient demand for mass market homes among end-users.

At Parktown Residence, about 65% of the units were transacted at between $2,200 psf and $2,399 psf, while 82% of the units sold were priced at below $2.5 million (See Table 1) in February, based on URA Realis caveat data. Over at ELTA, about 45% of the units sold have a unit price ranging from $2,400 psf to $2,599 psf, while nearly 77% of the total sales in February were priced at below $2.5 million. Quantum play will remain a key pricing strategy for developers, and a price range of between $1.5 million and $2.5 million appears to be a pricing sweet-spot that many owner-occupiers are relatively comfortable with.

Table 1: Proportion of sales at ELTA and Parktown Residence by $PSF unit price and price range in February 2025

$PSF price | ELTA | PARKTOWN RESIDENCE | Price range | ELTA | PARKTOWN RESIDENCE |

$2,000-$2,199 | 0.0% | 0.3% | $1 mil - <$1.5 mil | 15.0% | 20.7% |

$2,200-$2,399 | 17.5% | 65.4% | $1.5 mil - <$2 mil | 40.5% | 41.1% |

$2,400-$2,599 | 45.1% | 34.3% | $2 mil - <$2.5 mil | 21.2% | 20.4% |

$2,600-$2,799 | 34.7% | 0.0% | $2.5 mil - <$3 mil | 16.3% | 12.3% |

$2,800-$2,999 | 2.8% | 0.0% | $3 mil - <$3.5 mil | 6.1% | 4.2% |

Total | 100% | 100% | $3.5 mil - <$4 mil | 0.9% | 1.1% |

$4 mil - <$4.5 mil | 0% | 0.2% | |||

Total | 100% | 100% | |||

Interestingly, it seems like the average unit price of some recent new launches has decoupled from the sub-market where these projects are located. By way of general pecking order, CCR prices tend to be higher than the RCR, while prices in the RCR are usually a step up from that of the OCR. However, it appears that this pricing rubric may not necessarily hold true always, based on observations from launches of late.

Table 2: Number of units sold and average $PSF price at selected new launches from November 2024 till February 2025

Project | Launch date | Region | Tenure | Total units sold* | Average of unit price ($PSF)* |

UNION SQUARE RESIDENCES | Nov 24 | RCR | 99 | 115 | $3,175 |

THE COLLECTIVE AT ONE SOPHIA | Nov 24 | CCR | 99 | 73 | $2,743 |

THE ORIE | Jan 25 | RCR | 99 | 680 | $2,734 |

EMERALD OF KATONG | Nov 24 | RCR | 99 | 845 | $2,639 |

CHUAN PARK | Nov 24 | OCR | 99 | 744 | $2,589 |

ELTA | Feb 25 | OCR | 99 | 326 | $2,544 |

BAGNALL HAUS | Jan 25 | OCR | FH | 80 | $2,489 |

NAVA GROVE | Nov 24 | RCR | 99 | 416 | $2,460 |

PARKTOWN RESIDENCE | Feb 25 | OCR | 99 | 1,041 | $2,369 |

Take The Collective at One Sophia in the CCR for instance, it has sold 73 units at an average unit price of $2,743 psf since it was put on the market in November. This is lower than the average transacted price of units sold at Union Square Residences ($3,175 psf) in the RCR, and only slightly higher than that of The Orie ($2,734 psf), also in the RCR (see Table 2). Meanwhile, the average unit price of some OCR launches - Chuan Park, ELTA, and Bagnall Haus (freehold) - are higher than that of Nava Grove in the RCR.

Some possible reasons why the average unit price for some projects had seemingly de-linked from the Region could include site-specific attributes and amenity-driven pricing, deeper private housing demand (including from HDB upgraders) in certain areas pushing up prices, and perhaps to some extent the blurring of lines between regions for developments that are located on the cusp of the CCR (e.g. Union Square Residences). Going forward, there are several new RCR projects that are situated just off the CCR, being One Marina Gardens in Marina South, and upcoming developments in Zion Road. As RCR projects nearer to the CCR are being launched, we anticipate RCR prices may track closer to CCR levels, potentially narrowing the price gap between the two sub-markets in certain months (when the projects do come on).

In February, foreigners (non-PR) made up 0.7% of the non-landed new private home sales (ex. EC) - down from 1.1% in January. In absolute terms, there were 11 transactions by foreign buyers (NPR): one each at Meyer Blue, The Continuum, and The Lakegarden Residences; and two each at 19 Nassim, 32 Gilstead, ELTA, and Orchard Sophia. Meanwhile, Singaporean buyers accounted for 92.4% of the non-landed new home sales, and Singapore Permanent Residents at 6.9% during the month, according to caveats lodged.

The primary market started the year brightly, continuing the positive sentiment from end-2024. We remain cautiously optimistic about developers' sales in 2025. There is still a long stretch to go and it is not without downside risks, including uncertainties in the global economy in view of geopolitical tensions and trade fictions which may be disruptive to growth. At this juncture, we are maintaining our new home sales forecast at 8,000 to 9,000 units (ex. EC) for 2025."

Table 3: Top-Selling Private Residential Projects (ex. EC) in February 2025

| S/n | Project | Region | Units sold in Feb 2025 | Median price in Feb 2025 ($PSF) |

1 | PARKTOWN RESIDENCE | OCR | 1,041 | $2,363 |

2 | ELTA | OCR | 326 | $2,538 |

3 | PINETREE HILL | RCR | 22 | $2,613 |

4 | NAVA GROVE | RCR | 18 | $2,574 |

| HILLOCK GREEN | OCR | 18 | $2,098 |

5 | HILLHAVEN | OCR | 13 | $2,216 |

6 | THE CONTINUUM | RCR | 10 | $2,906 |

7 | KASSIA | OCR | 9 | $2,065 |

8 | TERRA HILL | RCR | 8 | $2,574 |

9 | GRAND DUNMAN | RCR | 7 | $2,541 |

| BAGNALL HAUS | OCR | 7 | $2,469 |

| THE ORIE | RCR | 7 | $2,669 |

10 | SCENECA RESIDENCE | OCR | 6 | $2,050 |

| MEYER BLUE | RCR | 6 | $3,243 |